Report Overview

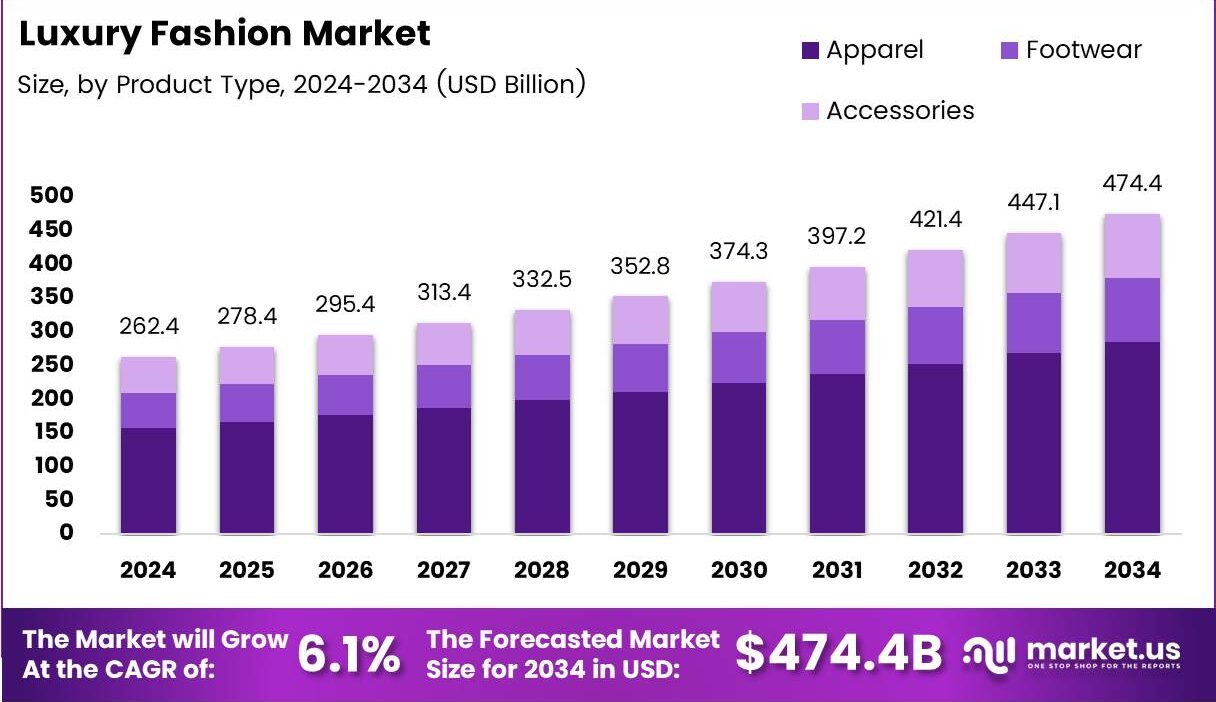

The Global Luxury Fashion Market size is expected to be worth around USD 474.4 Billion by 2034, from USD 262.4 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The luxury fashion market encompasses high-end apparel, accessories, and footwear characterized by premium quality, exclusivity, and prestigious brand value. It caters to affluent consumers who prioritize craftsmanship, design innovation, and status symbolism, driving demand for luxury products worldwide.

Analysts observe consistent growth in the luxury fashion market, propelled by rising disposable incomes and evolving consumer preferences. According to LuxuryTribune, China is expected to lead this expansion with a projected 4–6% growth in 2024, underscoring the region’s pivotal role in the global luxury landscape.

![]()

![]()

Moreover, opportunities abound as younger, trend-focused consumers increasingly engage with luxury brands. A July 2024 Morning Consult survey cited by FashionDive revealed that 58% of luxury shoppers expect improved financial situations within a year, highlighting positive consumer sentiment and potential spending increases.

However, shifting consumer behaviors indicate a demand for affordability alongside luxury. FashionDive reports that 51% of luxury buyers now prefer more affordable options if available, signaling brands must balance exclusivity with accessible pricing strategies to capture wider audiences.

Transitioning to brand loyalty, PwC’s 2024 Asia-Pacific consumer survey notes that nearly 40% of respondents are open to switching brands offering better value for money. Additionally, 25% consider brand quality and trustworthiness critical factors, emphasizing the importance of brand reputation in purchasing decisions.

Governments also play a crucial role by fostering favorable investment climates and regulating trade policies that impact the luxury fashion market. Supportive regulations around intellectual property protection and import tariffs enable luxury brands to safeguard designs and expand market access efficiently.

In parallel, investment in sustainable practices by luxury fashion players aligns with tightening regulations on environmental impact. This creates an opportunity for brands to innovate eco-friendly luxury collections, meeting both regulatory demands and evolving consumer expectations for sustainability.

Furthermore, digital transformation enhances market reach, with government initiatives promoting e-commerce infrastructure enabling luxury brands to penetrate emerging markets effectively. This technological advancement boosts sales channels and customer engagement, complementing traditional retail.

Key Takeaways

- The global luxury fashion market is projected to reach US$ 474.4 billion by 2034, up from US$ 262.4 billion in 2024, with a CAGR of 6.1% from 2025 to 2034.

- In 2024, Apparel dominated the product type segment with a 51.3% market share, highlighting consumer preference for high-quality, trendy apparel.

- Women accounted for a leading 43.1% share in the end-user segment in 2024, emphasizing focus on women’s luxury fashion.

- Store-based distribution channels held a dominant 74.8% share in 2024, driven by demand for personalized in-store shopping experiences.

- The Asia-Pacific region led the market with a 38.2% share, valued at about US$ 99.7 billion, supported by rising incomes, urbanization, and growing demand for premium brands.

Product Type Analysis

Apparel leads with a commanding 51.3% share, reflecting strong consumer preference and market demand.

In 2024, the luxury fashion market’s product type segment was significantly influenced by Apparel, which held a dominant market position with a 51.3% share. This leadership underscores the continued consumer inclination towards high-quality and trendy apparel as the primary category in luxury fashion.

Footwear followed as a key contributor, catering to customers seeking exclusive and stylish shoes that complement their luxury wardrobes. Although its market share is less than Apparel, Footwear remains a vital segment due to ongoing innovation and design trends that attract fashion-forward buyers.

Accessories, while the smallest segment, play a crucial role in completing luxury outfits and enhancing brand prestige. This category includes premium watches, bags, and jewelry that appeal to niche consumers looking for distinctive and status-symbol items. The steady interest in Accessories suggests potential for growth as luxury consumers seek to diversify their style statements.

Overall, the Product Type segment shows a robust preference for Apparel but continues to be supported by strong demand in Footwear and Accessories, driving the overall luxury fashion market forward in 2024.

End-User Analysis

Women dominate with a 43.1% share, highlighting their pivotal role in the luxury fashion market.

In 2024, Women held a dominant market position in the end-user segment of the luxury fashion market, accounting for a significant 43.1% share. This reflects the extensive focus on women’s luxury fashion, with tailored collections and marketing strategies designed to meet their evolving preferences and lifestyles.

Men represent an important segment that continues to grow as male consumers increasingly invest in luxury apparel and accessories, driven by rising fashion awareness and disposable income. This segment offers promising opportunities for brands to expand their product lines and tailor services accordingly.

Children’s luxury fashion, while smaller, remains a niche market with consistent demand for high-end, stylish clothing and accessories for young consumers. Families looking for quality and exclusivity contribute to this segment’s sustained presence.

The end-user analysis reveals that Women’s dominance shapes product innovation and marketing, but the presence of Men and Children segments provides avenues for diversified growth in the luxury fashion market in 2024.

![]()

![]()

Distribution Channel Analysis

Store-Based channels dominate with a strong 74.8% share due to consumer preference for in-person luxury shopping experiences.

In 2024, Store-Based distribution channels held a dominant position in the luxury fashion market, capturing a commanding 74.8% share. This dominance is largely driven by consumers’ preference for tactile and personalized shopping experiences, which physical stores uniquely provide.

Luxury boutiques and flagship stores serve as important brand touchpoints, offering exclusive services and immersive environments that enhance customer loyalty. The tangible experience of examining quality, fit, and craftsmanship remains vital in luxury retail.

Non-Store Based channels, including online platforms and direct-to-consumer sales, continue to grow but have not yet overtaken the stronghold of traditional retail stores. These channels appeal to tech-savvy customers seeking convenience and accessibility but are still developing trust in luxury authenticity and service quality.

Overall, the Distribution Channel segment indicates that while digital adoption is increasing, physical stores remain the cornerstone of luxury fashion retail, emphasizing the importance of experiential shopping in 2024.

Key Market Segments

By Product Type

- Apparel

- Footwear

- Accessories

By End-User

By Distribution Channel

- Store-Based

- Non-Store Based

Drivers

Integration of AI and Virtual Try-On Technology Boosts Luxury Fashion Market

The luxury fashion market is growing rapidly due to the integration of AI and virtual try-on technology. These tools allow customers to see how clothes and accessories look on them without physically trying them on. This makes shopping more convenient and engaging, especially for online buyers. AI also helps brands understand customer preferences better, offering personalized recommendations that enhance the shopping experience.

Luxury brands are also expanding their direct-to-consumer (DTC) channels. By selling directly through their websites and exclusive stores, brands can connect closely with customers and keep full control over their image. This shift reduces reliance on third-party retailers and allows for better customer service and loyalty programs.

Another important driver is the high spending power of millennials and Gen Z consumers in emerging markets. These younger generations are eager to invest in luxury products as a symbol of status and self-expression. Their growing influence in countries like China and India is pushing brands to innovate and cater specifically to their tastes.

Additionally, ethical consumerism is shaping the luxury fashion market. More buyers want transparency about how products are made and demand sustainable, cruelty-free materials. Luxury brands responding to these concerns gain trust and loyalty, which drives further growth in this sector.

Restraints

Fluctuations in Raw Material Costs Challenge Luxury Fashion Market Growth

One major challenge for the luxury fashion market is the fluctuation in raw material costs. Prices of key materials like leather, silk, and precious metals can vary significantly, impacting production expenses. These fluctuations make it hard for brands to maintain stable pricing and profit margins.

Supply chain disruptions are also a concern. Events like global pandemics or political instability can delay shipments or limit access to materials. Such interruptions affect product availability and can harm customer satisfaction and brand reputation.

Counterfeit products pose another threat. Fake luxury items flood the market, reducing the perceived value of genuine products. This undermines consumer trust and can damage a brand’s prestige, especially if customers accidentally buy counterfeits.

Furthermore, high entry barriers exist for new players in the luxury fashion market. Established brands benefit from long-standing heritage and strong customer loyalty, making it difficult for newcomers to compete. New entrants need significant investment and innovation to attract attention.

Lastly, regulatory hurdles related to sustainability and ethical sourcing add complexity. Compliance with environmental laws and fair labor standards often requires costly adjustments in manufacturing, which can slow down growth and raise prices.

Growth Factors

Personalization and Customization Open New Growth Paths for Luxury Fashion

Personalization and customization are key growth opportunities in the luxury fashion market. Advanced customer relationship management (CRM) tools allow brands to tailor products and experiences to individual preferences. This level of personalization attracts high-end buyers seeking unique items and strengthens brand loyalty.

Expanding into untapped Tier-II and Tier-III cities worldwide offers another chance for growth. Many consumers in these smaller cities are gaining purchasing power and desire luxury products. Brands that successfully enter these markets can capture new customer bases and increase revenue.

Strategic collaborations between luxury brands and streetwear labels are also driving growth. These partnerships blend exclusivity with urban culture, appealing to younger and more diverse audiences. Such collaborations create buzz and introduce luxury fashion to a wider public.

Finally, the monetization of digital collectibles and NFT-based fashion assets presents innovative growth potential. Digital ownership of exclusive fashion items in virtual spaces attracts tech-savvy consumers. This trend opens new revenue streams and strengthens brand presence in the digital world.

Emerging Trends

Popularity of Gender-Neutral and Inclusive Lines Shapes Luxury Fashion Trends

A growing trend in luxury fashion is the popularity of gender-neutral and inclusive clothing lines. Brands are designing collections that break traditional gender boundaries, appealing to a broader and more progressive audience. This inclusivity helps attract new customers and reflects changing social attitudes.

Eco-conscious capsule collections and limited editions are also trending. These small, sustainable product lines emphasize quality over quantity and highlight a brand’s commitment to the environment. Customers increasingly value such efforts, which boosts brand reputation and loyalty.

Luxury resale platforms and circular fashion models are gaining traction as well. Consumers are embracing second-hand luxury items and sustainable buying habits. This shift encourages brands to participate in resale markets and rethink their production cycles.

Lastly, the use of metaverse platforms for brand engagement and virtual stores is transforming luxury shopping. Brands create immersive digital experiences where customers can explore collections and purchase virtual fashion. This innovative approach attracts younger audiences and expands brand reach globally.

Regional Analysis

Asia-Pacific Dominates the Luxury Fashion Market with a Market Share of 38.2%, Valued at USD 99.7 Billion

The Asia-Pacific region leads the global luxury fashion market with a commanding 38.2% share, valued at approximately USD 99.7 billion. This dominance is fueled by rising disposable incomes, rapid urbanization, and a growing consumer base with a strong preference for premium brands. Economic growth in key countries like China and India, coupled with expanding e-commerce channels, significantly boosts demand in this region.

![]()

![]()

Regional Mentions:

In North America, the luxury fashion market is robust, supported by high consumer spending power and a well-developed retail landscape. The market here is estimated to contribute a substantial portion of global revenue, driven by strong brand loyalty and a shift towards sustainable and experiential luxury products.

The Europe luxury fashion market, known for its rich heritage and iconic brands, holds a significant share of the global market value. Valued in the tens of billions of US dollars, Europe benefits from high tourist inflow and a sophisticated consumer base that appreciates craftsmanship and innovation in fashion.

The Middle East & Africa region is emerging as a key player with increasing luxury consumption, supported by rising wealth and investments in premium retail infrastructure. The market size in this region is growing steadily, reflecting a rising demand for luxury goods, especially in affluent urban centers.

The Latin America luxury fashion market is gradually expanding, with its value reaching several billion US dollars. Economic improvements and growing urbanization, alongside increased tourism, are driving interest in luxury brands despite regional challenges, presenting promising opportunities for future growth.

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global luxury fashion market continues to be strongly influenced by leading players, each bringing unique strengths to the industry.

Armani Group remains a powerhouse known for its timeless elegance and innovative designs. The brand’s ability to blend classic Italian craftsmanship with modern trends has helped it maintain a strong presence across diverse luxury segments, appealing to both traditional and younger affluent consumers.

Burberry has effectively leveraged its British heritage while embracing digital transformation. The brand’s strategic focus on sustainability and cutting-edge marketing campaigns, particularly through social media, has expanded its reach to younger luxury buyers globally. Burberry’s commitment to innovation in fabric technology and inclusive luxury has reinforced its competitive edge.

Chanel continues to dominate the luxury market with its iconic products and strong brand equity. The house’s commitment to exclusivity and craftsmanship, combined with a carefully curated retail experience, sustains high consumer demand. Chanel’s investment in maintaining artisanal skills while exploring new markets ensures its enduring appeal in an increasingly competitive landscape.

Hermes stands out for its dedication to heritage and unparalleled quality, especially in leather goods and accessories. The brand’s strategy of limited product availability fosters a sense of exclusivity, driving desirability and long-term value. Hermes’ steady expansion in Asia and other emerging luxury markets highlights its global growth potential, reinforcing its status as a leader in the luxury fashion industry.

Top Key Players in the Market

- Armani Group

- Burberry

- Chanel

- Hermes

- Kering

- LVMH

- Capri Holdings

- Moncler

- MCM

- OSKLEN

- Salvatore Ferragamo

- Tapestry

- Tom Ford

- Dolce & Gabbana

- Hugo Boss

- Max Mara Group

- Prada Group

Recent Developments

- In March 2025, Purple Style Labs (PSL), the parent company of Pernia’s Pop-Up Shop, secured US$40 million in a Series E funding round to enhance its omnichannel capabilities in luxury retail. This investment aims to strengthen their presence and customer experience across multiple retail channels.

- In March 2025, Zerow successfully raised €400,000 in pre-seed funding to promote sustainability in the luxury fashion sector. The company leverages AI-driven circular economy solutions to reduce waste and improve environmental impact.

- In November 2023, London-based Cult Mia obtained €2.8 million in funding to pioneer conscious luxury fashion through an innovative online platform. The investment will support their efforts in leading sustainable fashion trends in the digital marketplace.

- In October 2024, a supply chain platform backed by long-standing careers in luxury fashion secured US$17 million to scale its operations. The funding will be used to enhance supply chain transparency and efficiency within the luxury fashion industry.