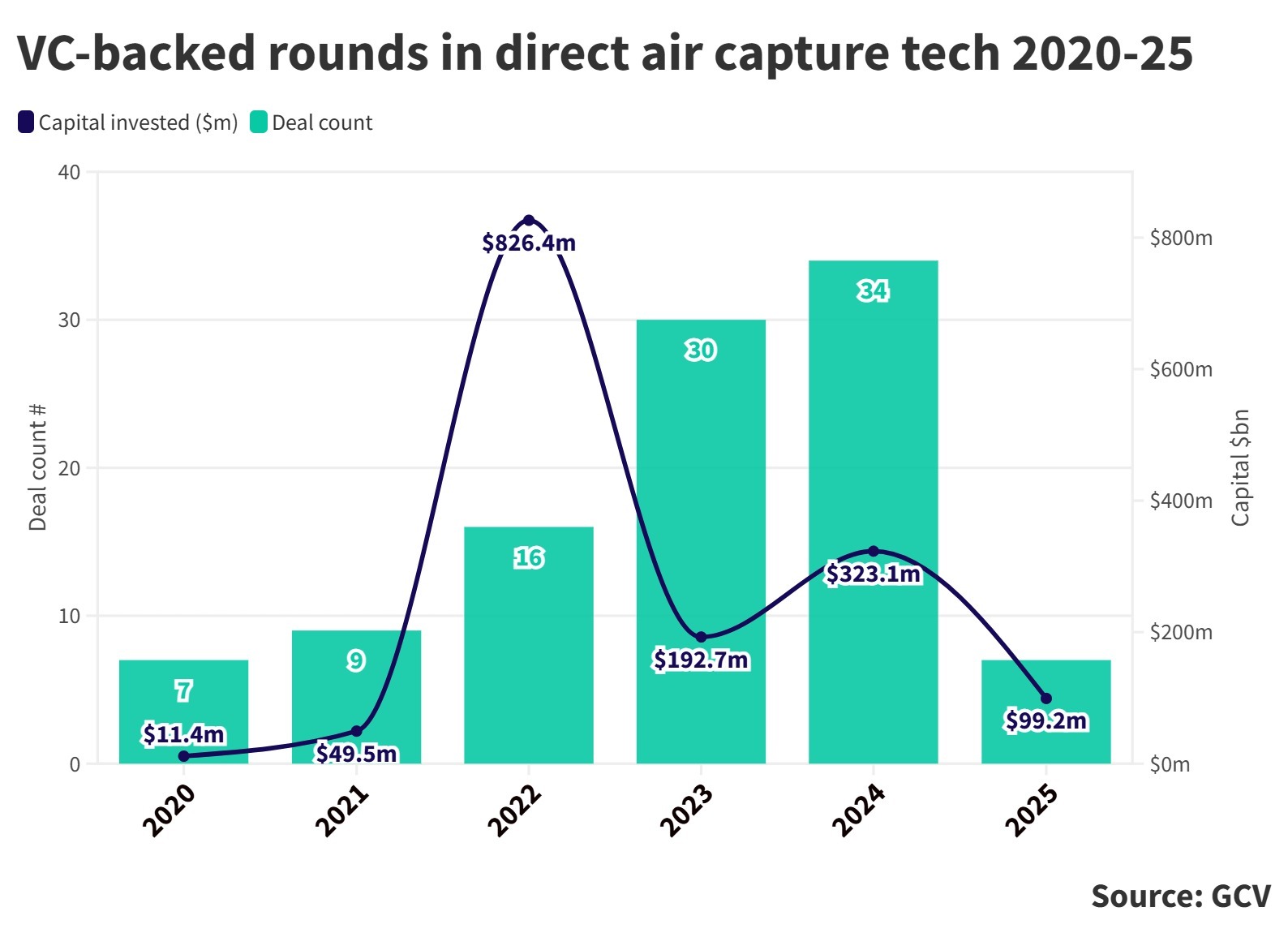

New materials and greater use of renewable energy is bringing down the costs of direct air capture of carbon. Here are eight startups with technology worth watching.

Once a niche, costly area of climate tech, direct air capture technology is maturing to the point where costs are coming down and corporates are investing.

A number of corporate investors have recently committed capital to direct air capture startup, including Aramco Ventures, the CVC of Saudi oil company Aramco, TDK Ventures, the investment unit of Japanese electronics maker TDK, and Coca-Cola Europacific Partners, Coca-Cola’s largest bottler.

Direct air capture refers to a broad range of technologies which strip carbon dioxide from the atmosphere. The CO2 can either be permanently removed by storing it underground, or it can be used to produce products such as building materials, carbonated drinks, chemicals and sustainable transportation fuels.

The air capture is done via either a chemical process or through an absorbent material that binds to the carbon dioxide. This is either a liquid or a solid (sorbent).

Expense has been a key barrier to commercialising these technologies. Direct air capture required a lot of energy, pushing up costs to $1,000 per tonne of captured carbon. Startups are now claiming they can remove carbon dioxide at a cost as low as $100 per tonne by using different materials and powering systems on renewable energy.

“$200 per tonne is the tipping point for voluntary market purchasing. By $100 per tonne, all the main purchasers are interested.”

Alex Dewar, managing partner at Boston Consulting Group

The option to reuse the captured carbon dioxide for other products, such as green transportation fuels and carbonated drinks, is also creating a commercial incentive to invest in the technology.

Technology costs have come down to the point that companies are also buying carbon credits generated from direct air capture technology to meet voluntary carbon reduction goals.

“We think $200 per tonne is the tipping point for voluntary market purchasing,” says Alex Dewar, managing partner at Boston Consulting Group. “There is really an inflection point at about $200 per tonne, where you go from 5% to 10% of the market that’s interested to well over 20% to 50%. By $100 per tonne, all the main purchasers of quality carbon dioxide removal credits are interested.”

The Global CCS Institute, an organisation that promotes carbon capture and utilisation technologies, lists several factors that have contributed to the drop in running costs for direct air capture. These include increased use of modular systems that can be mass produced, the deployment of the technology in regions with low heat and electricity costs, and the location of systems in hubs that have storage infrastructure.

Here is a list of eight direct air capture startups to watch that have different approaches to capturing CO2.

Airhive

Located: London, UK

Founded: 2022

Airhive’s modular direct air capture units capture CO2 from the air using a process called fluidisation. This process takes place when solids that are pushed upwards by a gas or liquid take on the properties of fluid. The process is a common, low-cost technology used in industries such as mineral processing and drying food.

Airhive’s technology captures air through its mineral-based sorbent at high speed, creating a process in which CO2 molecules rapidly collide with sorbent particles. This turbulence transforms the carbon-absorbing material into small particles with high surface areas, improving their capacity to capture CO2, according to the company.

Airhive’s sorbent material is electrically heated to release the CO2, which is processed in the DAC system. Since the system is fully electrified, 100% renewable energy can be used to power the process.

The captured CO2 can be used on-site to carbonate beverages, decaffeinate drinks or preserve foods. The company also offers customers the option to make sustainable aviation and shipping fuels from the captured CO2 and green hydrogen.

Coca-Cola Europacific Partners, the largest bottler of Coca-Cola, is an investor in the startup. Airhive is piloting its system at one of the bottler’s manufacturing sites, enabling it to capture CO2 from the atmosphere to replace fossil-fuel-derived carbon dioxide in its carbonated drinks.

Airhive raised its first investment round in 2024, which was co-led by hydrogen VC investor AP Ventures and Coca-Cola Europacific Partners. US-based, early-stage VC fund Collaborative Fund also participated in the round.

ZeoDac

Founded: 2023

Located: Georgia, US

This seed-stage company, spun out of US university California Institute of Technology, uses molecular sieves to remove carbon dioxide from the air. The sieves contain zeolites, a porous, crystalline material made of oxides consisting of mainly aluminium and silicon, and which occur naturally in the earth.

Unlike many other direct air capture companies, it does not use amines to chemically absorb CO2 from air. Amine absorbents degrade as they react with oxygen in air, releasing emissions of volatile organic compounds. Zeolites, on the other hand, do not release harmful chemicals into the atmosphere.

In addition to capturing CO2, ZeoDac harvests water that is produced as a byproduct during the process. This can be used in water scarce regions.

ZeoDac raised $4m in a seed round in 2024. Japanese VC investor Global Brain invested in the startup. Coca-Cola Europacific Partners is also an investor.

Noya

Founded: 2020

Located: San Francisco, US

The founders of this spinout from the Massachusetts Institute of Technology in the US have developed a low-power, modular direct air capture system that runs on renewable energy. It partners with CO2 storage companies to permanently store the gas underground.

Part of its service is to offer carbon removal credits to companies using its technology to reach greenhouse gas emissions reduction targets. Its operations are reviewed by third-party auditors to verify the carbon removal. The flow of CO2 is tracked and credits are then dispersed.

It also generates an excess of water that can be used in areas of drought.

Noya raised $11m in a series A in 2023. The funding round was led by Union Square Ventures and Collaborative Fund. Other backers include VCs Climate Capital, Pioneer Fund and SOMA Capital.

Spiritus

Founded: 2022

Located: US

The company uses a solid sorbent material that removes carbon from the atmosphere at a low temperature and with minimal energy use. It has invented a direct air capture approach that it calls a “Carbon Orchard”. This approach uses passive air contact, without the use of fans, and a low temperature desorption process that is part of a modular design which can be easily scaled.

It also measures, reports and verifies the carbon removal to produce carbon credits for greenhouse gas reduction goals

Several corporate investors took part in the company’s $30m series A in March 2025. The funding round was led by Aramco Ventures, the investment arm of Saudi state-backed oil company Aramco. Mitsubishi Heavy Industries America and TDK Ventures, the CVC of Japanese electronics manufacturer TDK, also participated.

In 2024, Spiritus entered an agreement with the Kingdom of Saudi Arabia to pilot and scale the technology in the Middle Eastern country.

Mission Zero Technologies

Founded: 2020

Located: London, UK

The company’s electrochemical direct air capture technology is inspired by the biological reactions that manage carbon dioxide in the body. It captures carbon in the air by dissolving it in a solution and passing it through a membrane. Renewable electricity is used to regenerate the carbon dioxide.

Rather than storing the CO2 underground or processing it for reuse, it mineralises the gas into rock. The company partners with Canadian carbon removal project developer Deep Sky, which has a test facility in Quebec, Canada. The containerised system will recover 250 tonnes of CO2 a year.

The system will eventually use Canada’s large reserves of hydroelectric energy to remove gigatonnes of CO2 from the atmosphere by the end of the decade. It is using Mission Zero’s direct air capture system to demonstrate carbon removal on a small scale before eventually building commercial facilities that can capture between 100,000 and one million tonnes of CO2 annually for permanent mineralisation.

In April, the company opened a new direct air capture plant in Norfolk, UK, to turn CO2 into limestone to make building materials.

Mission Zero Technologies raised $27.6m in a series A in 2024 led by VC 2150. Corporate investors Australian mining group Fortescue and German engineering group Siemens also participated, as well as Breakthrough Energy Ventures.

Octavia Carbon

Founded: 2023

Located: Nairobi, Kenya

This African startup is vertically integrated, designing, manufacturing and deploying direct air capture machines. The technology uses fans to suck in air, which goes through a filter material that is heated under vacuum conditions to release captured CO2.

The CO2 is injected underground into basalt formation along the Great Rift Valley where the gas mineralises over time.

The company touts Kenya as an ideal place for direct air capture technology because the country’s grid is 93% renewable, with 48% coming from geothermal sources. The Great Rift Valley, a series of contiguous geographic depressions in east Africa, has basalt formations that are well suited for storing captured CO2. Once injected into the ground, the CO2 mineralises into stable carbonates.

In 2024, Octavia Carbon raised $5m in seed funding, co-led by Lateral Frontiers and E4E Africa. Launch Africa Ventures, Catalyst Fund, Renew Capital and Fondation Botnar also participated. Some of the funding came from the contracted presale of carbon credits.

Phlair

Founded: 2022

Located: Munich, Germany

This startup’s main innovation is a hydrolyser that it claims lowers carbon capture energy costs compared with thermal direct air capture technologies.

The system uses a basified solvent to absorb CO2. The solvent is mixed with acid to release the gas for storage or for reuse. The hydrolyser generates fresh acid that can be used to repeat the process. The hydrolyser runs on renewable energy and can be ramped up and down depending on the availability of intermittent energy sources.

The company has a pilot project that captures 10 tonnes of CO2 a year at a facility in Ismaning, Germany. It has two other pilots planned: one in Rotterdam, Netherlands, which will capture 260 tonnes of CO2 a year and generate carbon credits for Shopify, Klara and Stripe; and a partnership with Canadian project developer Deep Sky to run a pilot in Innisfail, Canada, capturing 260 tonnes of CO2 a year.

Phlair raised €14.5m in seed funding in 2024. The round was led by Extantia Capital, with participation from Planet A and Verve Ventures.

Parallel Carbon

Founded: 2021

Located: US

The company’s technology captures carbon dioxide from the atmosphere while also producing clean hydrogen and relying solely on renewable energy sources. Its goal is to capture carbon for less than $100 per tonne and produce clean hydrogen for $1 per kilogram.

The system uses calcium hydroxide to capture CO2 from the air using a water treatment process instead of high temperatures normally required to extract the CO2. The captured carbon reacts with calcium hydroxide to transform into limestone.

The system’s water electrolysis technology runs on renewable energy. The energy breaks down water molecules into acids and bases. With the same electrons it produces clean hydrogen as a byproduct.

In 2024, the company closed a $3.6m seed funding round led by Aramco Ventures. Other investors include Counteract, Axon Partners, DNX Ventures, Voyagers and Rumbo Ventures.